For the year ended 31 March

2016

2015

Change

Operating results (US$ million)

Revenue

1,856.5

1,879.8

-1.2%

Gross profit

583.3

610.5

-4.5%

Operating profit

202.3

220.1

-8.1%

Profit before taxation

203.1

221.7

-8.4%

Profit attributable to shareholders of the Company

181.4

198.1

-8.4%

Financial position (US$ million)

Cash generated from operations

242.8

250.4

-3.0%

Deposits and cash

273.0

294.2

-7.2%

Shareholders’ funds

525.0

540.8

-2.9%

Per share data (US cents)

Earnings per share – basic

72.2

78.9

-8.5%

Earnings per share – diluted

72.2

78.9

-8.5%

Dividend per share – interim and final

42.0

78.0

-46.2%

Other data (US$ million)

Capital expenditure

38.3

30.9

23.9%

R&D expenditure

56.3

56.1

0.4%

Key ratios (%)

Gross profit margin

31.4

32.5

-1.1% pts

Operating profit margin

10.9

11.7

-0.8% pts

Net profit margin

*

9.8

10.5

-0.7% pts

EBITDA/Revenue

12.8

13.4

-0.6% pts

Return on shareholders’ funds

34.6

36.6

-2.0% pts

* Net profit margin is calculated as profit attributable to shareholders of the Company as a percentage of revenue

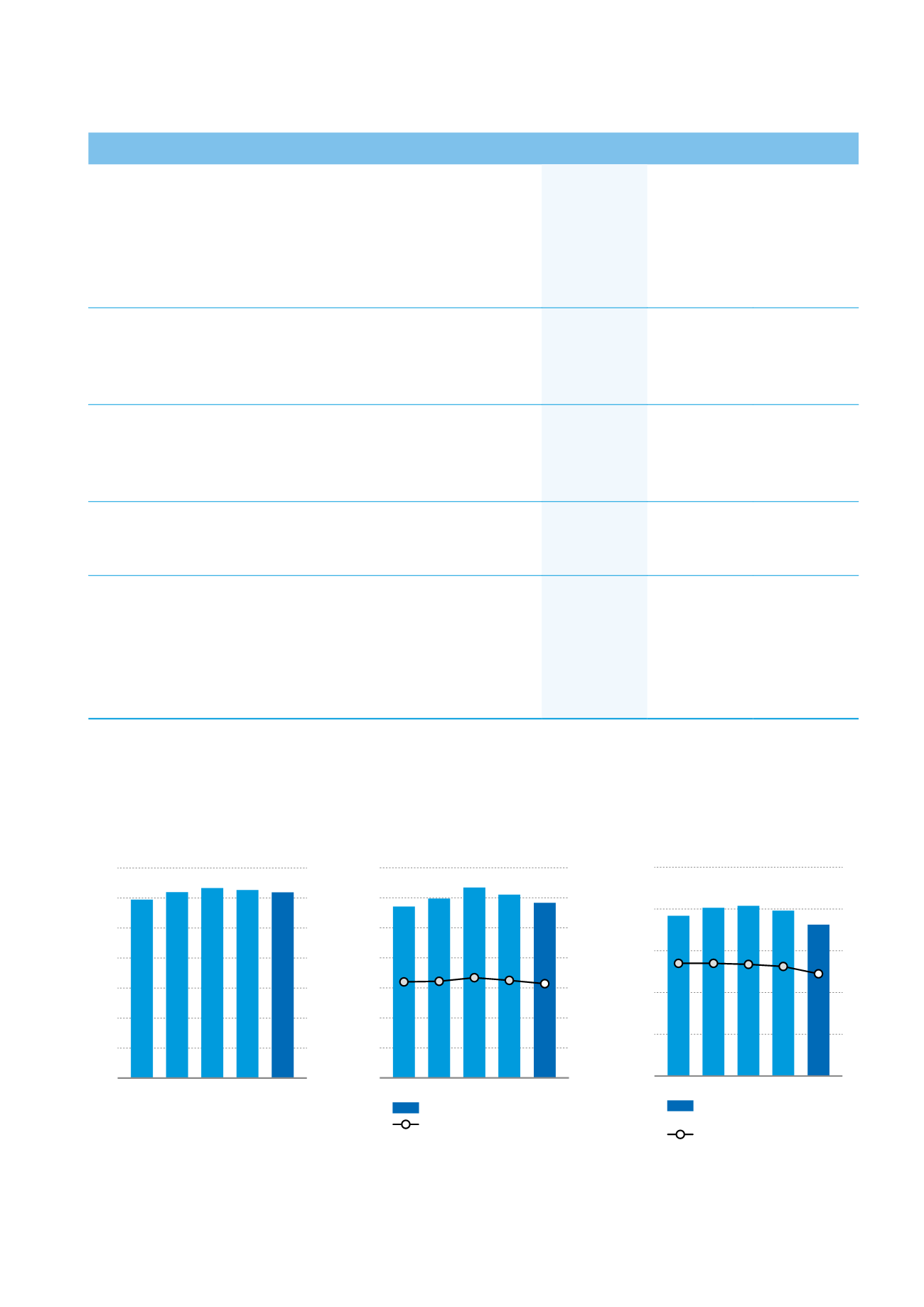

Profit Attributable to Shareholders

of the Company and Net Profit

Margin in Last 5 Years

US$ million

Profit attributable to shareholders

of the Company (US$ million)

Net profit margin (%)

250

200

150

100

50

0

12 13 14 15 16

191.9 201.5 203.8

181.4

198.1

20

16

12

8

4

0

%

10.8 10.8 10.7 10.5

9.8

Gross Profit and Gross Profit Margin

in Last 5 Years

US$ million

Gross profit (US$ million)

Gross profit margin (%)

700

600

500

400

300

200

100

0

12 13 14 15 16

570.8 597.8

634.3

583.3

610.5

70

60

50

40

30

20

10

0

%

32.0 32.2 33.4 32.5 31.4

Group Revenue in Last 5 Years

US$ million

2,100

1,800

1,500

1,200

900

600

300

0

12 13 14 15 16

1,784.5

1,858.0 1,898.9

1,856.5

1,879.8

1

VTech Holdings Limited

Annual Report 2016

Financial Highlights