Management Discussion and Analysis

Financial Review

Financial Overview

For the year ended 31 March 2015

2015

US$ million

2014

(Restated)

US$ million

Change

US$ million

Revenue

1,879.8

1,898.9

(19.1)

Gross profit

610.5

634.3

(23.8)

Gross profit margin

32.5%

33.4%

Total operating expenses

(390.4)

(407.7)*

17.3

Total operating expenses as a percentage of revenue

20.8%

21.5%

Operating profit

220.1

226.6*

(6.5)

Operating profit margin

11.7%

11.9%

Net finance income

1.6

1.4

0.2

Profit before taxation

221.7

228.0*

(6.3)

Taxation

(23.6)

(24.2)

0.6

Effective tax rate

10.6%

10.6%

Profit for the year and attributable to shareholders of the Company

198.1

203.8*

(5.7)

Net profit margin

10.5%

10.7%

* Restated upon the change of accounting policy as described in note B to the financial statements

Revenue

Group revenue for the year ended 31 March 2015 reduced by 1.0% to US$1,879.8

million compared with the previous financial year. The decrease in revenue was

largely driven by lower sales in North America, which offset the increase in revenue

in Europe, Asia Pacific and other regions.

2015

2014

Increase/(decrease)

US$ million

%

US$ million % US$ million %

North America

899.5 47.8%

950.7 50.1% (51.2) (5.4%)

Europe

812.3 43.2%

791.8 41.7%

20.5 2.6%

Asia Pacific

117.6 6.3%

108.9 5.7%

8.7 8.0%

Other regions

50.4 2.7%

47.5 2.5%

2.9 6.1%

1,879.8 100.0%

1,898.9 100.0% (19.1) (1.0%)

Gross Profit/Margin

Gross profit for the financial year 2015

was US$610.5 million, a decrease of

US$23.8 million or 3.8% compared to

the US$634.3 million recorded in the

previous financial year. Gross profit

margin for the year also reduced

from 33.4% to 32.5%. It was mainly

attributable to the change in product

mix and the weaker-than-expected

performance of children’s educational

tablets, which resulted in the higher-

than-anticipated trade allowances

and increase in stock provisions.

The labour costs and manufacturing

overheads, however, were slightly lower

as the Group continued to improve

productivity through automation,

process improvements and product

optimisation to offset the higher wages

in China. Cost of materials also remained

largely stable in the financial year 2015.

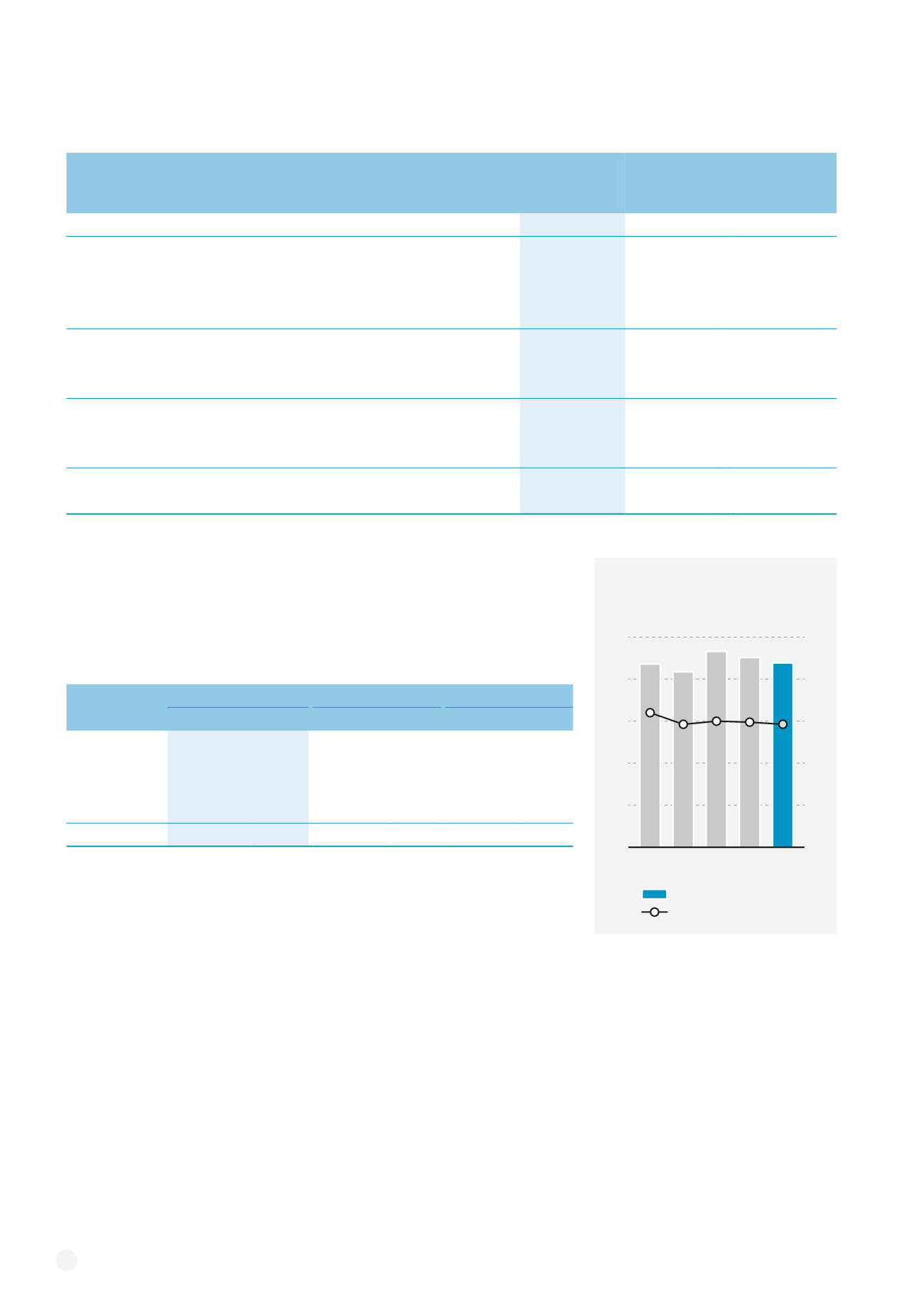

Operating Profit/Margin

Operating profit for the year ended

31 March 2015 was US$220.1 million,

a decrease of US$6.5 million or 2.9%

compared with the previous financial

year. It was mainly due to the decrease

in gross profit and gross profit margin,

which offset the decrease in total

operating expenses.

Operating profit margin reduced from

11.9% to 11.7%. It was mainly due to the

decrease in gross profit margin, which

offset the decrease in total operating

expenses as a percentage of Group

revenue. The ratio of EBITDA to revenue

declined from 13.6% to 13.4%.

Operating Pro t and Operating

Pro t Margin in Last 5 years

US$ million

* Restated

Operating pro t (US$ million)

Operating pro t margin (%)

250

200

150

100

50

0

11 12 13 14 15

218.7

209.5

223.9 226.6* 220.1

20

16

12

8

4

0

%

12.8

11.7 12.0 11.9 11.7

8 VTech Holdings Limited

Annual Report 2015