Dividends

During the financial year 2015, the Group declared and paid an interim dividend of

US17.0 cents per share, which aggregated to US$42.7 million. The Directors have

proposed a Final Dividend of US61.0 cents per share, which is estimated to be

US$153.2 million.

2015

US cents

2014

US cents

Dividend per share

Interim

17.0

16.0

Final*

61.0

64.0

Total

78.0

80.0

* Final dividend proposed after the balance sheet date

Total operating expenses were

US$390.4 million, a decrease of

4.2% over the last financial year.

Correspondingly, total operating

expenses as a percentage of Group

revenue declined from 21.5% to 20.8%.

Selling and distribution costs declined

from US$286.4 million to US$268.2

million, a decrease of 6.4% compared

with the last financial year. It was mainly

attributable to the decreased spending

on advertising and promotional activities

by the Group during the financial year

2015. As a percentage of Group revenue,

selling and distribution costs reduced

from 15.1% to 14.3%.

Administrative and other operating

expenses increased from US$63.3

million to US$66.1 million over the same

period last year. It was mainly due to

the increase in employee related costs,

which was partially offset by a lower

exchange loss of US$0.3 million arising

from the Group’s global operations

in the ordinary course of business, as

compared with an exchange loss of

US$0.4 million in the last financial year.

Administrative and other operating

expenses as a percentage of Group

revenue increased from 3.3% to 3.5%.

During the financial year 2015, the

research and development expenses

were US$56.1 million, a decrease of 3.3%

compared with the previous financial

year. Research and development

expenses as a percentage of Group

revenue decreased from 3.1% to 3.0%.

Profit Attributable to

Shareholders and Earnings

per Share

Profit attributable to shareholders of the

Company for the year ended 31 March

2015 was US$198.1 million, a decrease of

US$5.7 million or 2.8% as compared to

the last financial year. Net profit margin

also reduced from 10.7% to 10.5%.

Taxation charges declined from US$24.2

million in the last financial year to US$23.6

million in the financial year 2015. The

effective tax rate remained at 10.6%.

Basic earnings per share for the year

ended 31 March 2015 were US78.9 cents

as compared to US81.3 cents in the

previous financial year.

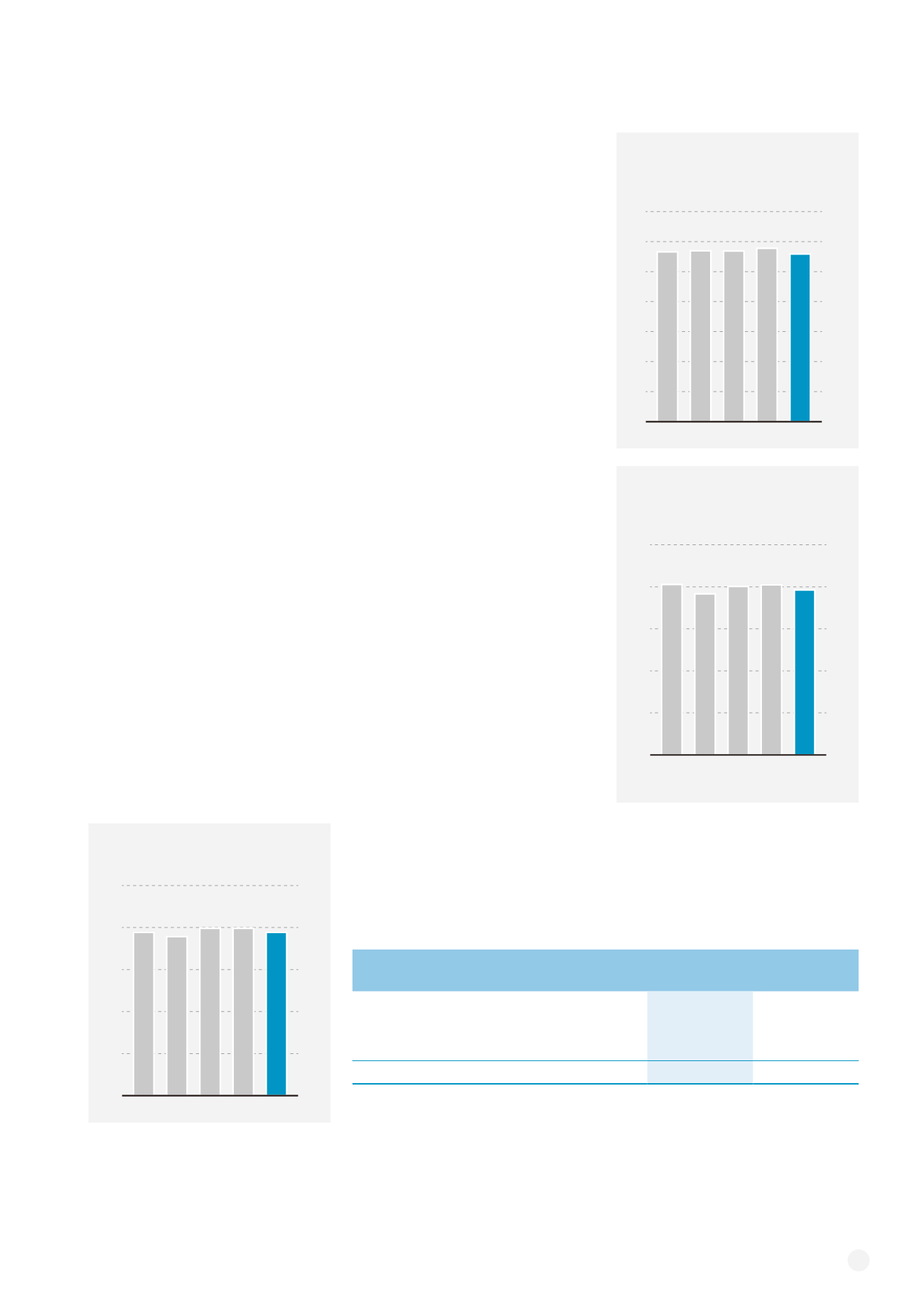

Group R&D Expenditure

in Last 5 Years

US$ million

70

60

50

40

30

20

10

0

11 12 13 14 15

56.8 57.2 57.1

58.0

56.1

Basic Earnings per Share

in Last 5 Years

US cents

* Restated

100

80

60

40

20

0

11 12 13 14 15

81.5 77.0 80.6 81.3* 78.9

100

80

60

40

20

0

11 12 13 14 15

78.0

76.0

80.0 80.0 78.0

Dividend per Share in Last 5 Years

US cents

9

VTech Holdings Limited

Annual Report 2015