- Group revenue rose 1.5% to US$2,177.2 million as Gigaset sales consolidated

- Gross profit margin of 31.5%, up from 29.6% in FY2024

- Profit attributable to shareholders of the Company decreased 5.9% to US$156.8 million

- Final dividend of US44.0 cents per ordinary share, resulting in a full-year dividend of US61.0 cents per ordinary share, a decrease of 6.2% from the previous financial year

- Successful integration of Gigaset

- Vertical integration and global manufacturing footprint enable VTech to remain resilient in evolving tariff situation

- Strong financial position

Hong Kong, 14 May 2025 – VTech Holdings Limited (HKSE: 303) today announced its results for the year ended 31 March 2025.

“VTech reported an increase in revenue in the financial year 2025 despite an increasingly challenging business environment. Sales in Europe rose following the integration of Gigaset Technologies GmbH (Gigaset), augmented by growth in Other Regions. This offset lower sales in North America and Asia Pacific. Profit declined owing to lower operating profit, as total operating expenses rose. The Group has continued to diversify its production globally, mitigating the effects of the recently announced tariffs on imports to the US,” said Mr. Allan Wong, Chairman and Group CEO of VTech Holdings Limited.

Results and Dividend

Group revenue for the year ended 31 March 2025 increased by 1.5% to US$2,177.2 million, from US$2,145.7 million in the previous financial year. Higher sales in Europe and Other Regions offset lower sales in North America and Asia Pacific. The higher revenue in Europe was due to the consolidation of Gigaset sales following the acquisition of the assets of GST Communications GmbH on 5 April 2024.

Profit attributable to shareholders of the Company decreased by 5.9% to US$156.8 million. The decline in profit was mainly due to lower operating profit, as total operating expenses rose. This was primarily due to the integration of the Gigaset operations, which resulted in correspondingly higher selling and distribution costs, administrative and other operating expenses, as well as research and development (R&D) expenses.

Basic earnings per share decreased by 6.1% to US62.0 cents, compared to US66.0 cents in the financial year 2024.

The Board of Directors has proposed a final dividend of US44.0 cents per ordinary share, providing a full-year dividend of US61.0 cents per ordinary share, a 6.2% decrease from the US65.0 cents declared in the previous financial year. This represents a dividend payout ratio of 98.5%.

Costs

The Group’s gross profit margin in the financial year 2025 rose to 31.5%, as compared with 29.6% in the financial year 2024. This was due to three factors. Cost of materials was lower as material prices declined. There was a positive change in the product mix and there was a gross profit contribution from Gigaset. These factors offset several negative developments. Direct labour costs and manufacturing overheads rose owing to the expansion of the factory workforce following the integration of workers at the Gigaset factory in Germany. The Group also ramped up production and increased inventory levels to optimise capacity utilisation at its production facilities, further increasing direct labour costs and manufacturing overheads. Cost increases were exacerbated by higher freight rates and tariff costs as compared with the previous financial year. These impacts offset the effect of a depreciation of the Renminbi and further improvements in productivity.

Impact of US Tariffs

Beginning in 2018, the US introduced a series of tariffs for goods made in China. In response, VTech has been diversifying its manufacturing footprint, starting in the same year with its first facility outside China in Muar, Malaysia. This expansion has continued, with the acquisition of an additional facility in Penang, Malaysia in 2020 and in Tecate, Mexico, in 2021. The acquisition of Gigaset in 2024 extended the Group’s manufacturing operations to Bocholt, Germany.

In 2025, US tariffs have been expanded to cover imports from nearly all countries, alongside additional tariffs targeting Chinese goods. Faced with these uncertainties, VTech is accelerating the relocation of its production of US bound products away from China. This migration started with contract manufacturing services (CMS) in 2018, followed by telecommunication (TEL) products in 2020. Transfer of electronic learning products (ELPs) production is now in progress. The Group is aiming to complete the transfer of its production of US bound products away from China within 2026.

Segment Results

North America

Group revenue in North America decreased by 3.2% to US$893.1 million in the financial year 2025, as higher sales of ELPs were offset by declines in TEL products and CMS. North America became VTech’s second largest market, accounting for 41.0% of Group revenue.

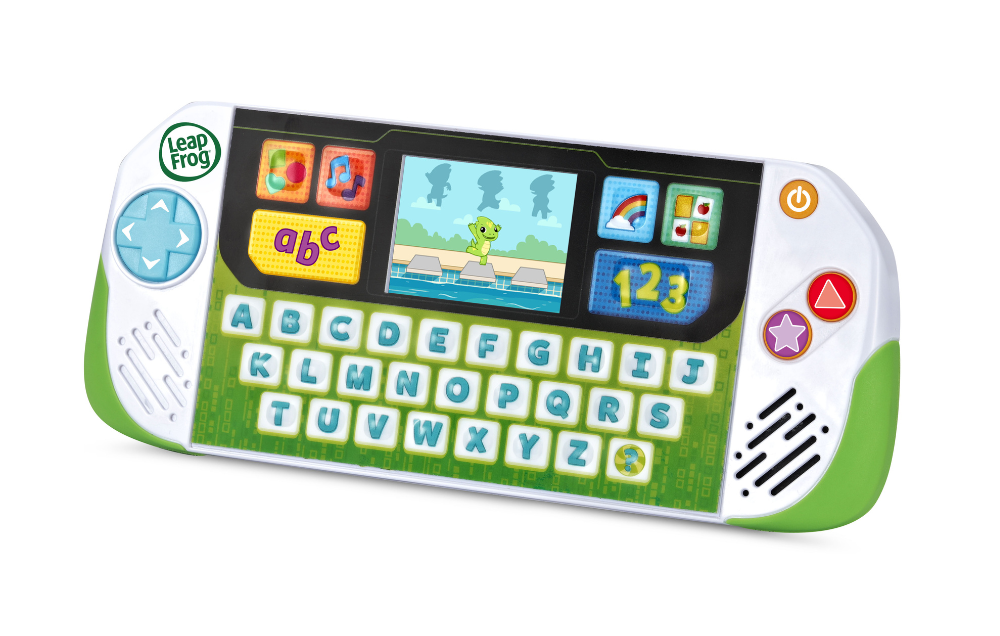

ELPs revenue in North America increased by 7.0% to US$444.9 million. Sales rose in both the US and Canada as the toy markets stabilised in the calendar year 2024. VTech was able to take full advantage of this improvement as the new leadership team in the US successfully implemented a revitalised sales and marketing strategy, boosting growth. Both standalone and platform products registered higher sales and VTech strengthened its leadership in electronic learning toys from infancy through toddler to preschool in the US in the calendar year 2024 [1]. In Canada, sales also grew as VTech branded products achieved higher sales and VTech regained its number one position in the infant, toddler and preschool toys category in the calendar year 2024[2].

There were higher sales of standalone products for both the VTech and LeapFrog brands. For VTech, growth in preschool products, the Kidi® line and KidiZoom® cameras offset lower sales of infant and toddler products, the Go! Go! Smart family of products, Switch & Go® Dinos and Marble Rush®. LeapFrog saw higher sales of infant, toddler and preschool products, eco-friendly toys and the Magic Adventures® series, with the successful roll-out of Magic Adventures Binoculars contributing additional revenue. This offset lower sales of LeapLand Adventures™.

In platform products, both the LeapFrog and VTech brands registered higher sales. LeapFrog sales were pushed higher by children’s educational tablets, interactive reading systems and Magic Adventures Globe. Subscriptions to LeapFrog Academy™, however, posted a decline. At VTech, sales of Touch & Learn Activity Desk™ increased and a new generation of smartwatch, KidiZoom Smartwatch DX4, boosted sales of this popular product line. These increases offset a decline for KidiBuzz™.

In March 2025, the Group launched an exciting line-up of new VTech and LeapFrog products at Toy Fair 2025, expanding its popular baby, infant, toddler and preschool categories. VTech reinforced its commitment to fostering developmental milestones through play with six new products. These included Explore & Write Deluxe Activity Desk™, an interactive learning desk that combines touch-sensitive technology with engaging content to help children learn letters, numbers, shapes and more. LeapFrog’s four new items included those blending physical activity with engaging educational experiences, while others incorporated scientifically-based approaches to phonics, vocabulary and comprehension instruction to develop reading skills. Touch & Learn eReader™, for example, features ten built-in stories that can be read aloud, encouraging early learners to follow along with the words on screen.

In total, the Group earned over 60 industry awards and from trusted parenting websites, toy industry experts, toy advisory boards and major retailers during the financial year 2025. In the US, VTech’s Sort & Discover Activity Wagon™ was named to Walmart’s “2024 Top Toys List” and KidiZoom Smartwatch DX4 made Target’s “2024 Bullseye’s Top Toys” list. Sort & Discover Activity Wagon was named a “Parents Best Toys Award Winner”, alongside three more of the Group’s ELPs. VTech’s Go! Go! Smart Wheels® Checkered Flag Motorised Track Set™ and LeapFrog’s Magic Adventures Binoculars were made Toy of the Year (TOTY) Finalists by the Toy Association. In Canada, Sort & Discover Activity Wagon and the Go! Go! Smart Wheels Checkered Flag Motorised Track Set were named to Walmart and Toys“R”Us “2024 Top Toys” lists respectively.

TEL products revenue in North America fell by 11.0% to US$178.8 million in the financial year 2025, as sales in all three product categories declined.

Sales of residential phones were lower, as the US residential phones market saw further contraction. Despite this, VTech remained the number one US cordless phone brand[3] and launched a new range of AT&T phones in the financial year 2025. The Group also achieved success in expanding sales through online channels.

Commercial phones and smartphones experienced a decline in sales, despite growth in hotel phones and headsets. Orders for SIP (Session Initiation Protocol) phones fell as a customer lost market share in the face of strong competition. This offset the good performance of hotel phones, where VTech gained market share. Sales in this category were boosted by a new series of competitively priced models with sleek styling that was launched during the financial year 2025, as well as increasing sales of thermostats for the hotel channel. Headsets also reported modest growth, as a customer increased orders.

Other telecommunication products also posted a sales decrease. Sales of baby monitors contracted as competition rose, while those of CareLine® residential phones fell owing to weak demand. This offset modest growth in integrated access devices (IADs), as a customer increased orders. Nonetheless, VTech retained its position as the number one baby monitor brand in the US and Canada during the financial year 2025[4]. VTech was named as the most trusted baby monitor brand in the “BrandSpark Most Trusted Awards 2025” in both the US and Canada. In the US, the Group’s baby monitors won two “Baby Maternity Awards”, including the “2024 Top Choice Award”, and two “Motherhood Loves Community Awards”. Two VTech brand baby monitors also gained the “Parent Tested Parent Approved Seal of Approval” in Canada.

CMS sales in North America decreased by 11.9% to US$269.4 million in the financial year 2025. There were lower sales of professional audio equipment, solid-state lighting and of IoT (Internet of Things) products, despite gaining a new customer. This offset higher sales of industrial products.

Professional audio equipment reported lower sales as a slow economy led to a drop in end-user demand, resulting in sales decreases for power amplifiers and audio mixers. Over-inventory at a key customer led to a reduction in orders for professional loudspeakers. Solid-state lighting experienced a decline as the number of projects fell because of the slowing economy. IoT products reported lower sales as a customer experienced a financial issue, offsetting gains from new orders for smart basketball hoop game consoles. In contrast, industrial products posted growth as a sales contribution from a new customer in smart water leakage detectors offset a decline in PCBA (printed circuit board assembly) for coin and note recognition machines. During the financial year 2025, the CMS facility in Tecate, Mexico became fully operational, offering full-turnkey EMS (electronic manufacturing services) capability to customers. VTech has been assisting customers affected by the new US tariff policy to transfer their production there.

In the financial year 2025, VTech CMS gained two US awards in recognition of its outstanding services, namely a “Pathfinder Award” from a professional audio equipment customer and a “Strategy Vendor 2024” award from the new IoT products customer.

Europe

Group revenue in Europe increased by 8.2% to US$960.7 million in the financial year 2025, as higher sales of TEL products offset declines for ELPs and CMS. Europe became VTech’s largest market, accounting for 44.1% of Group revenue.

ELPs revenue in Europe fell by 2.7% to US$307.0 million, with declines in both standalone and platform products. Sales declined in France, Germany and the Benelux countries, affected by slow economic growth and a weak Euro. This offset rises in the UK, where there was a sales increase at a major e-tailer, and Spain, where the Group saw higher sales at its key customers. In Italy, sales continued to grow following the establishment of a sales office in the country in 2023. In the calendar year 2024, VTech remained the number one infant and toddler toys manufacturer in France, the UK, Germany, Spain, Belgium and the Netherlands[5].

In the standalone category, growth in the LeapFrog brand was offset by a decline for VTech. At LeapFrog, infant and toddler products saw higher sales, boosted by the successful launch of Magic Adventures Binoculars. By contrast, sales of eco-friendly toys were stable, while those of preschool products and LeapLand Adventures declined. VTech achieved higher sales of infant, toddler and preschool products, as well as the Kidi line. However, these gains were insufficient to compensate for lower sales of the Toot! Toot! family of products, KidiZoom cameras, Marble Rush, electronic learning aids and Switch & Go Dinos.

For platform products, growth in LeapFrog was offset by a decline for VTech. At LeapFrog, sales of Magic Adventures Globe were higher, while those of interactive reading systems remained stable. For VTech, sales of children’s educational tablets, KidiZoom Smartwatch, the KidiCom® range and Touch & Learn Activity Desk were all lower.

The Group’s ELPs won numerous awards across Europe during the financial year 2025, encompassing a wide array of products. In the UK, VTech’s Kidi DJ Drums and Sort & Discover Activity Wagon, as well as LeapFrog’s My 1st Phonics: Spin & Learn, each won a “Gold Award” in the “MadeForMums Toy Awards 2024”. In France, V-Bot Explorer, Mon robot 5 en 1 (5-in-1 Make-a-Bot™) and Genius XL – Jumelles vidéo interactives (Magic Adventures Binoculars) were awarded “Grands Prix du Jouet 2024” by La Revue du Jouet magazine. VTech was also named the “Best Toy Brand 2025” (La marque de jouets pour enfants) in France by the organisation Marques et familles. VTech and LeapFrog products gained similar accolades in other European markets. There were “Toy of the Year 2024” awards for Kidi DJ Drums and Sew & Style Kitty Bag/Unicorn Bag from the Dutch and Belgian Toy Associations respectively. The Spanish Toy Association named both Magic Adventures Binoculars and Marble Rush Storage Box “Best Toy of the Year 2024” in different categories.

Revenue from TEL products in Europe increased by 173.8% to US$211.4 million in the financial year 2025. Residential phones, commercial phones and smartphones, as well as other telecommunication products all recorded sales increases.

Residential phones saw sales move higher. The growth was driven by the revenue contribution from Gigaset, following the acquisition of the assets of GST Communications GmbH on 5 April 2024, as well as increased sales of VTech branded phones in the UK. The Gigaset brand performed especially well in Germany, Austria, Switzerland and Belgium, allowing it to maintain its leadership position in the European residential DECT (Digital Enhanced Cordless Telecommunications) phone market[6]. The solid sales performance was underpinned by the Gigaset Comfort 550 and A690 models, which offer elegant design, ease-of-use and attractive features such as long talk time and hearing aid compatibility. In the UK, VTech branded cordless phones continued to make good progress as the Group broadened its distribution channels and achieved higher sales via a major e-tailer.

The category of commercial phones and smartphones also recorded growth in the financial year 2025. This was mainly attributable to the consolidation of Gigaset revenue, comprising mainly sales of Gigaset’s multicell DECT system, augmented by those of smartphones, a new category for VTech. Hotel phones also reported higher sales. These increases offset a decline for Snom branded SIP phones.

The Gigaset multicell DECT system supports Microsoft Teams, Asterisk, Broadsoft, 3CX and more. Its alarm, messaging and location feature is unique in the market and makes it particularly attractive to companies with employees working in environments such as warehouses, hospitals and factories. Gigaset’s smartphones comprise powerful entry-level and mid-range models, together with accessories, as well as those tailored to specific user groups such as seniors and those working outdoors. Sales of hotel phones increased as the Group added new distribution channels and expanded into more European markets. Sales of Snom branded SIP phones declined, however, as they were affected by the slow market conditions.

Recognising market requirements, the final quarter of the financial year 2025 saw a new entry-level version of the popular Snom D8 series introduced to cater to different customers. In addition, three new SIP desksets were added to the Gigaset professional ranges, completing its product line-up. Ranging from a compact all-round device to a Wi-Fi connected premium model with a 5-inch LCD (liquid crystal display) colour display, the new models have been well-received by the market.

Other telecommunication products posted higher sales. Growth in baby monitors offset declines in CAT-iq handsets and CareLine residential phones, while sales of IADs were immaterial. Higher sales of baby monitors were driven by good performances in the UK and France. Sales of CAT-iq handsets and CareLine residential phones were affected by lower orders from ODM customers due to subdued end-user demand. During the financial year 2025, VTech retained its position as the number one baby monitor brand in the UK[7]. VTech was named as the number one baby monitor brand in the “UK Newsweek/BrandSpark Most Trusted Awards”[8]. In the UK, the Group’s baby monitors won four “LovedbyParents” awards and a “Project Baby Award”. There were also four “Dadsnet Awards 2024”, including “Gold Winner (Best Technology Product)” for the RM7768HD Baby Monitor.

CMS revenue in Europe fell by 10.7% to US$442.3 million. Lower sales of professional audio equipment, hearables, communication products and smart energy storage systems offset higher sales of IoT products and automotive products. Sales of home appliances and medical and health products were stable.

In professional audio equipment, sales of home audio interface products were lower. This resulted from weak market demand and an unsuccessful new product launch by a customer. Hearables sales decreased as the customer lost market share. Sales of communication products were affected by lower orders for wireless routers as the customer over-stocked inventory prior to moving production to a new location. Smart energy storage systems were impacted by the removal of subsidies by the Swedish government and higher competition. On the positive side, IoT products grew on rising orders for internet connected thermostats and air-conditioning controls, as the customer successfully increased sales by selling directly to businesses. Sales of automotive products also increased, with orders for EV (electric vehicle) chargers rising as VTech gained market share.

During the financial year 2025, VTech CMS won six supplier awards in Europe. There were two “Best Supplier 2024” awards and one “Supplier of the Year 2024” award given by professional audio equipment customers, a “Partner of the Year 2024” award and “Best Supplier 2024” award from IoT products customers and a “Preferred Supplier 2024” award from an automotive products customer.

Asia Pacific

Group revenue in Asia Pacific fell by 5.3% to US$300.9 million in the financial year 2025, as sales of all three product lines declined. The region accounted for 13.8% of Group revenue.

Revenue from ELPs in Asia Pacific decreased by 2.3% to US$68.8 million. Sales declined in Australia, Hong Kong and South Korea, which offset growth in China. In Australia, sales experienced a slight decline as an increase for the VTech brand was offset by a decrease for LeapFrog. In the calendar year 2024, VTech maintained its position as the number one manufacturer of electronic learning toys from infancy through toddler to preschool in the country[9]. Sales in Hong Kong fell because of lower sales to a key customer, while the underperformance of a distributor led to the decline in South Korea. In China, online sales showed growth, offsetting a decline in offline channels.

During the financial year 2025, VTech’s Snugglepillar was awarded the “Plush Product of the Year” by the Australian Toy Association. Six products also made Amazon Australia’s “2024 Top 100 Toy List”, namely VTech’s KidiZoom Duo FX, Scooter Time Bluey, Sort & Discover Activity Wagon, Tasty Treats Axolotl, V-Bot® and LeapFrog’s Magic Adventures Binoculars. In China, Turbo Edge Riders™ and Marble Rush Sky Elevator Set™ won the Sustainability Award and Innovative Design Award respectively from CBME (Children Baby Maternity Expo) China, while the Fly & Learn Globe™ was named “Innovative Product of the Year” in the “Cherry Awards 2024”.

TEL products revenue in Asia Pacific decreased by 12.2% to US$18.7 million owing to lower sales in Australia and Japan. In Australia, sales declined because of lower sales of residential phones and baby monitors. In Japan, sales were affected by reduced orders for residential phones from an ODM customer.

CMS sales in Asia Pacific decreased by 5.6% to US$213.4 million, with lower sales of professional audio equipment, communication products and medical and health products. This was despite sales contributions from new Chinese customers in home appliances and IoT products. Professional audio equipment was affected by a slowdown in the market for DJ equipment as the market softened. In communication products, orders for marine radios fell as the customer continued to transfer production back in-house to Japan to take advantage of the weaker Japanese yen. Medical and health products declined on lower orders for diagnostic ultrasound systems as the customer lost market share in China. The Group did, however, acquire new customers in China in the areas of cooking robots and smart rings.

During the financial year 2025, VTech CMS earned a “Certificate of Appreciation” from a professional audio equipment customer in Asia Pacific.

Other Regions

Group revenue in Other Regions, comprising Latin America, the Middle East and Africa, rose by 31.6% to US$22.5 million in the financial year 2025. The increase was due to higher sales of ELPs and TEL products. Other Regions accounted for 1.1% of Group revenue.

ELPs revenue in Other Regions increased by 6.9% to US$9.3 million as growth in Latin America and the Middle East offset a decline in Africa.

TEL products revenue in Other Regions rose by 57.1% to US$13.2 million. The increase was attributable to sales growth in Latin America and the Middle East, offsetting a decrease in Africa. This included a sales contribution from Gigaset.

CMS revenue in Other Regions was immaterial in the financial year 2025.

Outlook

As the challenges to global manufacturing posed by US tariff policy intensify, VTech’s vertical integration and global manufacturing footprint enable it to remain resilient in evolving tariff situation. The Group’s advantageous position arises from its strong balance sheet and fully integrated operations across Asia, Europe and Americas, which are enabling it rapidly to realign its supply chain. Additionally, VTech’s diversified product lines, respected brands and robust global sales network will support its growth worldwide.

To mitigate tariff effects, VTech is accelerating the relocation of its production of US bound products to Malaysia, Mexico and Germany. In the US, some tariff costs will be passed on through higher prices, using tailored pricing strategies developed in negotiation with retailers. The Group is also focusing on expanding its sales in emerging markets.

The volatile US tariff situation and the negative economic outlook are impacting Group revenue, which is now forecast to decline in the financial year 2026. Customers are placing orders more cautiously, while US consumers are increasingly focusing on essential purchases in response to rising retail prices.

Gross profit margin is projected to be largely stable. Cost of materials is likely to remain little changed owing to weakening global demand. Labour costs and manufacturing overheads are predicted to be higher, as wages at the Group’s manufacturing facilities have recently increased. Logistics costs are also expected to rise. These cost increases, along with the increased tariff costs, will be offset by higher prices, a more favourable product mix and stronger European currencies.

ELPs revenue in the financial year 2026 is expected to decline due to the US tariff policy. Although sales outside the US are anticipated to increase, this will be offset by a decline in the US market. The Group is nevertheless targeting growth in its market share globally. An exciting range of innovative new products will support sales worldwide. Standalone products will see expansions of the core learning category, licensed products portfolio and ever-popular Kidi line. Platform products will be strengthened by a brand-new motion-based learning platform, a revamped interactive reading system and a new generation of Touch & Learn Activity Desk.

Sales of TEL products are forecast to grow in the financial year 2026, as the synergies with Gigaset ramp up. To drive residential phones sales, a new range of DECT phones is being developed to target the high-end segment. Commercial phones and smartphones will see a new series of Gigaset single cell DECT phones, as well as new Gigaset smartphones designed for government bodies and other institutions that have strong privacy and security requirements. These will reach the shelves in the second quarter of the financial year 2026. The Group’s leadership in baby monitors will be strengthened by the addition of models with AI features that will be available by September 2025. Geographically, the Group will invest in developing markets for its TEL products in Eastern Europe. Gigaset has a well-established distribution network across Europe and the Group will support expansion by creating product lines tailored to these markets.

CMS revenue is projected to decrease in the financial year 2026 because of a generally weak global economy and rising geopolitical uncertainty. This is despite the success VTech has had in shielding itself and its customers from the effect of the US tariffs. Customers have become much more conservative when placing orders owing to the high degree of uncertainty about the global economy and political developments. The Group is actively helping affected customers to transfer their production to its facilities in Malaysia and Mexico, where the roll-out of i4.0 will raise productivity levels. To keep pace with demand, further expansion of the facilities in Muar, Malaysia is planned. VTech CMS will also build on its recent success in acquiring customers in China and offering more design support to customers.

“With a strong balance sheet, a global manufacturing footprint, recognised brands, and diverse product ranges supported by a robust global sales network, VTech is well-positioned for sustainable growth in the years ahead,” said Mr. Wong.

[1] Circana, LLC, Retail Tracking Service. Ranking based on total retail sales of VTech and LeapFrog products in the combined toy categories of Early Electronic Learning, Toddler Figures/Playsets & Accessories, Preschool Electronic Learning, Electronic Entertainment (excluding Tablets) and Walkers for the 12 months ended December 2024

[2] Circana, LLC, Retail Tracking Service, January – December 2024

[3] Circana, LLC, Retail Tracking Service, Cordless Phone, Dollars, January 2020 – December 2024

[4] Circana, LLC, Retail Tracking Service, US & CA, Tech, Baby Monitors, Dollar and Unit Sales, April 2024 – March 2025 Combined vs April 2023 – March 2024 Combined

[5] Circana, LLC, Retail Tracking Service, January – December 2024

[6] Gfk Retail and Technology UK Limited. Based on period January – December 2024

[7] GfK Retail and Technology UK Limited. Based on period April 2024 – March 2025

[8] The UK Newsweek/BrandSpark Most Trusted Awards survey, January 2025

[9] Circana, LLC, Retail Tracking Service, Ranking based on total retail sales of VTech and LeapFrog products in the combined toy categories of Early Electronic Learning, Toddler Figures/Playsets & Accessories, Preschool Electronic Learning, Electronic Entertainment (excluding Tablets) and Walkers for the 12 months ended December 2024

About VTech

VTech is the global leader in electronic learning products from infancy through toddler and preschool and the world’s largest supplier of residential phones. It also provides highly sought-after contract manufacturing services. Its culture of integrity, accountability and innovation guides the company towards a sustainable future.

Established in 1976, VTech has been the pioneer in the electronic learning toy category and its products incorporate advanced educational expertise and cutting-edge innovation. The Group’s telecommunication products elevate home and business users’ experience through the latest in technology and design. As a leading electronic manufacturing service provider, VTech offers full turnkey services in facilities that are moving towards Industry 4.0 manufacturing.

With a global workforce of over 20,000 employees in 19 countries and regions, VTech maintains R&D centres, manufacturing operations and sales subsidiaries across the Americas, Europe and Asia. Its products are sold in over 90 countries and regions, through partnerships with leading retailers, prominent e-commerce companies and distributors worldwide.

Shares of VTech Holdings Limited are listed on The Stock Exchange of Hong Kong Limited (HKSE: 303).